Historic manufacturer Joerns Healthcare files for bankruptcy protection in US amid “substantial” debt

Joerns Healthcare LLC, the American arm of the global patient handling manufacturer, has filed for bankruptcy protection in the United States as it seeks approval of a restructuring plan to reduce its “substantial amount of debt.”

With operations in the United States, the UK, Canada and the Netherlands and a history spanning 130 years, the company is a major international player in the patient handling and long-term care sector with its well-known Oxford and Hoyer patient hoists.

Additionally, the manufacturer was also one of the founding affiliate companies that led to the inception of mobility giant Sunrise Medical in the 80s.

An extensive history in healthcare

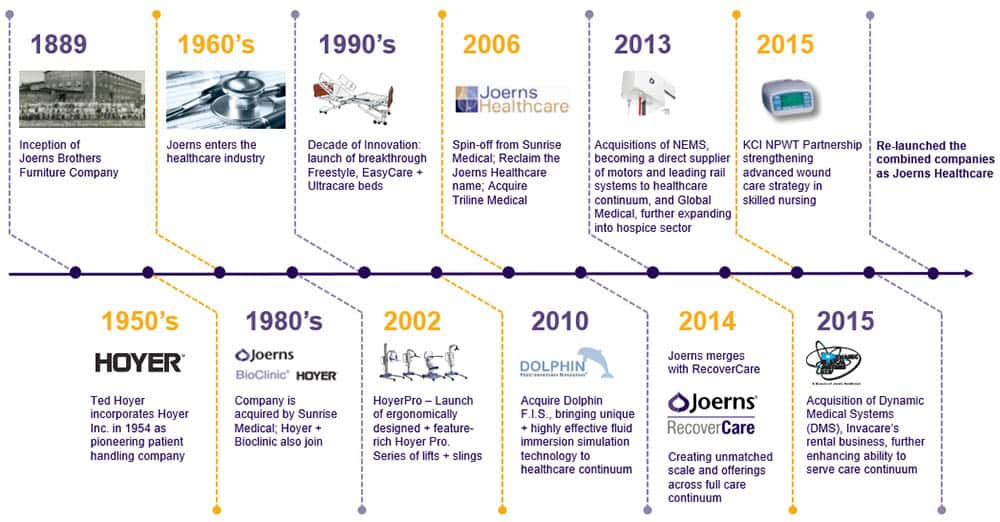

Formed in 1889 by brothers Charles, Paul and Frederick Joerns in the US state of Wisconsin and specialising in furniture, Joerns is one of the longest-running brands in the healthcare market, having entered the field in April 1952 when it began producing manual hi-low & fixed height hospital beds, cabinets and chairs for hospitals and nursing homes.

As the company expanded its activity in the sector over the following decades, with healthcare eventually becoming its core business, Joerns changed its name to Joerns Healthcare in 1983. It was also in the same year that Joerns would become one of four companies to affiliate, forming a new holding company, Sunrise Medical.

The merger allowed the newly-formed organisation to float on the stock exchange and complete an initial public offering to generate capital for expansion.

Over the following years, Sunrise Medical rapidly expanded, both in the US and internationally, completing many acquisitions which would go on to shape the modern healthcare and mobility industry today.

Joerns Healthcare sets out on its own

In 2006, Joerns Healthcare – then known as Sunrise Medical Long-term Care Division – was spun out from Sunrise Medical, becoming an independent company once again, along with DynaVox (acquired by Tobii in 2014) and DeVilbiss Healthcare (acquired by Drive Medical in 2015).

Financial struggles across the pond

Now employing over 1,700 employees throughout North America and Europe and manufacturing, supplying and servicing more than 120,000 items to more than 40,000 patients a day, Joerns Healthcare LLC is hoping its reorganisation plan will reduce its substantial debt.

According to the Wall Street Journal, the company hopes to reduce its debts to $80 million from $400 million.

Requesting that the plan be approved and the process complete within the next 30-45 days, the company says the package will also provide operating capital during the restructuring process and beyond.

David Johnson, President and Chief Executive Officer, commented: “By strengthening our financial footing, Joerns will be well-positioned to capitalise on the momentum we have started over the past six months, launching four new products to serve a range of customers throughout the complete continuum of patient care.

“These products bring new capabilities to an industry in need of fresh ideas and new approaches. They are tangible proof that Joerns is ready to be a leader in solving problems through innovative products, a reputation on which the company was built more than 125 years ago.”

Joerns Healthcare LLC has confirmed that during the restructuring process, all day-to-day operations will continue as normal, including customer deliveries, services and technical support, manufacturing schedules and payment of employees, suppliers and vendors.

A changing market

Underlining key changes taking place in the sector, David continued: “Joerns is well-positioned to support the fast-moving trends in healthcare, which include transitioning patients from acute care to home settings as quickly and safely as possible.

“We remain a solidly profitable company and this restructuring plan will help us move forward more quickly in both our core business lines and in new areas of patient care.”

The UK is unaffected

Importantly, the company emphasises that its UK and international operations are unaffected by the restructuring as the UK looks to capitalise on one of its most successful years to date in 2018.