Age UK research shows how the cost of living crisis is upending some people’s retirement plans

Modelling undertaken by the Pensions Policy Institute (PPI), published following a joint roundtable with Age UK on economic inactivity among older people, shows that many of those returning to the workforce after taking time out – as well as others in their 50s and early 60s who left work during or following the pandemic and who haven’t returned – could find that a comfortable standard of living in later life has moved further away from them.

In some cases, sadly, a comfortable retirement may now be beyond their reach completely, as high inflation continues to wreak havoc on carefully laid retirement plans.

The PPI modelling shows that someone on the National Living wage would need to find £26,000 to support themselves at their usual standard of living if they left work for two years, and a higher earner may need around £60,000. Some people may take this money from their pension pot and reduce their later pot level. In addition, someone on the National Living Wage could miss out on around £6,000 of pension contributions.

Another factor is the need of some older people who are feeling the pinch to draw down their defined contribution (DC) private pension funds just to keep going financially now, thereby reducing the amount available to fund their retirements later on. The PPI paper shows that more DC pension pots are being accessed for the first time than previously, revealing a year-on-year rise of 18 per cent – potentially having a significant impact on people’s retirement savings.

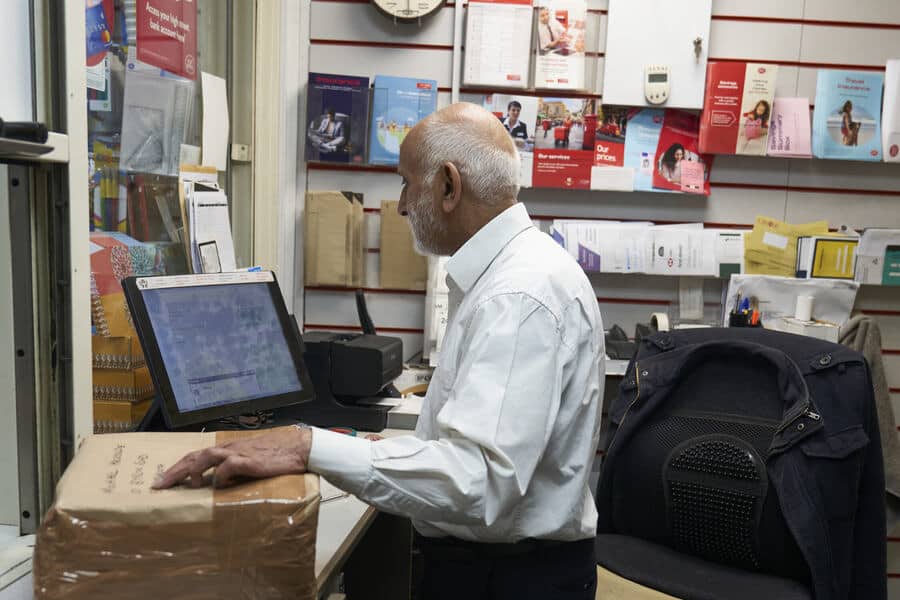

The ‘Great Un-Retirement’ appears to be in full swing, as the numbers of people who are out of the labour market despite not having reached their State Pension Age (SPA) have been reducing over the last year. 1.075 million people under the age of 65 are currently retired, down from a high of 1.196m nine months ago and 1.180 million this time last year. Age UK says that this strongly suggests that the cost of living crisis is forcing some people on the cusp of retirement to keep working and, in some cases beyond it, in order to make ends meet.

This impression is backed up by Opinium polling for Age UK, which earlier this year found that around 400,000 people approaching state pension age (9% of those aged 60-65), or another member of their household, had recently had to change their work habits, for example returning to work, working longer than expected or delaying retirement, in order to boost their income.

The PPI and Age UK roundtable also discussed what needs to happen to support people in their fifties and sixties to be able to stay in employment in the run-up to their State Pension Age. With average healthy life expectancy in the UK standing at just 62.8 years for men and 63.6 for women, Age UK is worried that having to wait until 66 for the State Pension is already bringing great hardship and anxiety to many older people who would like to work but who can’t because of ill health, disability or caring responsibilities, particularly at a time when the cost of living is soaring. The charity says they need more financial support so they can keep their heads above water, at a time when prices for most everyday items are rising fast due to inflation.

Age UK is also calling on the Government to seek to reduce economic inactivity among people in their fifties and sixties by developing policies that help those who are able to work into a job. Increasing access to flexible working and to training would make a real difference to these people’s ability to be in employment.

Caroline Abrahams, Charity Director at Age UK, said: “The cost of living crisis really is driving a coach and horses through many older people’s retirement plans, especially those without much money behind them. There’s growing evidence that some are having to postpone retirement because they don’t now have enough money coming in to pay the bills. Others who thought they could leave work for good and did so, partly in reaction to the pandemic, are having second thoughts and returning, but it’s usually too late for them to make up the shortfall in their pension contributions.

“Meanwhile, another group are really concerned about their ability to make ends meet today because of inflation but can’t work because they aren’t well enough, or are too disabled, or are caring for a loved one. It all boils down to the fact that hundreds of thousands of people in their fifties, sixties and beyond, who hoped and expected to be ok financially, definitely aren’t now, and are looking at the gloomy prospect of a less comfortable standard of living in future.

“As the cost of living crisis continues to exact a heavy toll, we think the Government needs to provide more generous financial support for people who cannot keep working until they become eligible for their State Pension, as well as increasing access to training and flexible working for those who can, thereby reducing the level of economic inactivity, which is one of their big goals. Policies like these would make a big difference to this age group and help our economy too.”

John Adams, Senior Policy Analyst at PPI, said: “Modelling undertaken by the PPI for Age UK shows that when people leave work before their planned retirement age, they have to find money to replace their earnings income. Pulling money out of pension savings early could have serious consequences for retirement income, through pot reduction.

“Additionally, those leaving work generally cease making pension contributions and miss out on the value of those they and their employer might have made had they stayed in work, and any investment returns they could have accrued. For example, leaving work 2 years before the planned retirement date may require someone to find around £25,500 in order to meet the target replacement rate to replicate living standard of a person earning £18,500 a year, over that time plus an additional £3,000 to cover pension contributions foregone.”

Age Uk recently reported that older people are often waiting far too long for the social care they need, warns Age UK, due to serious shortfalls of money and staff. It revealed new findings that 79 older people died every day in England in 2021/22 while waiting for care