More about… Kirton Healthcare

Consolidation driving differentiation

In recent years, the number of mergers and acquisitions in the healthcare industry and particularly in the world of mobility, independent living and pressure care have been on the rise. Acquisitions however can be a tricky business and a process that, if managed poorly, can lead to some disastrous consequences for companies. Following its acquisition of Kirton Healthcare, THIIS caught up with Rhys Donovan, Group Marketing Manager of Direct Healthcare Group (DHG), to discover how the Group’s strategic approach to acquisition is driving innovation in the specialist seating market and understand the importance behind managing the transition process following an acquisition effectively.

Investment in improvements

In recent years, the number of mergers and acquisitions in the industry has been on the rise, as organisations look to pool resources and expand product portfolios in search of market share. By their nature, however, acquisitions can prove to be a particularly turbulent time for companies, potentially leading to production disruptions and staff turnover.

One organisation that understands the importance of this period following an acquisition is DHG, who have invested in several key areas following their purchase of Kirton Healthcare in 2017.

“From the very start we wanted to be able to make four key promises to our customer; we would communicate to them within 24 hours upon initial contact, we would book an assessment within no more than three days, we would generate a quote within 24 hours of this assessment and we would deliver their chair within seven working days of their order,” Rhys opened.

DHG hoped these promises would lead to Kirton’s customers receiving a greater level of service than they were experiencing before the acquisition.

“I think the specialist seating market, in particular, is one that needs some innovation injected into it.” Rhys Donovan

“To help deliver these promises, we invested in tools for the clinical sales specialists by developing an app that allows them to quickly generate a customer quote following an assessment,” he continued.

“We also significantly improved the number of nationwide engineers providing our white glove service in the UK, increasing them from just three to 28. Perhaps most importantly, we invested heavily in our production facilities to significantly decrease the lead time across the Kirton product range.”

Why Kirton Healthcare?

The decision to acquire the specialist seating manufacturer was part of the Group’s overall strategic goal to drive innovation in the industry, says Rhys.

“Overall, the DHG vision is aimed at improving healthcare through movement, leading to increased independence and providing solutions to preventable problems,” he explained.

“Each acquisition has been made to help further that vision, with DHS being a pressure care specialist in mattresses, cushions and overlays, which has a natural synergy to the work Kirton does in specialist seating.”

According to Rhys, a key consideration behind the acquisition of Kirton was not only to expand the Group’s offering but also to bring invaluable expertise and knowledge into the organisation to help create new products.

This idea was also one of the key factors behind DHG’s decision to acquire Qbitus in May 2018.

“By bringing together our learnings and expertise in the areas of pressure care and hybrid technology, we knew we could deliver something special within the specialist seating sphere,” said Rhys.

“Now we have acquired Qbitus as well and are really looking at how we can bring those bespoke cushions into the Kirton range. It is really about bringing all these individual specialisms together to create unique solutions that can better people’s lives.”

The need to integrate

Key to the Group’s strategic vision is integration noted Rhys, combining the resources of individual companies to help improve efficiencies and enhance research and product development.

It is integration however that can often be the hardest element of an acquisition to manage, where an acquired company with its own ways of operating has to change and adapt to the methods of a new company.

For Kirton, the integration meant not only a change of processes but also a change of location.

“When we acquired Kirton in 2017, the company continued to operate for a time from its factory in Haverhill in Suffolk before we took the decision to amalgamate what were then three separate companies – DHS, Kirton and Nightingale – into one, large trading company to become DHG,” said Rhys.

“As part of that integration process, the decision was made, mostly for efficiency purposes, to move the factory down to Caerphilly where our DHS factory is.

The company removed walls and redesigned the floor space at its South Wales manufacturing facility, leading to the creation of 100,000 square feet of factory space where all DHS and Kirton products are produced.

“We began integrating most of the DHS pressure care cushion modules into the specialist seating range, so it made sense that to aid the integration, we should have the two companies next to each other,” noted Rhys.

Getting the transition right

Aware of the amount of change that has taken place at Kirton, with an MBO in 2013, an acquisition in 2017 and change of location in 2018, Rhys commented on the overall success of the move and transition.

“It is true to say that there has been quite a lot of change for the team at Kirton but overall, the transition and the move has been successful and went smoothly,” he remarked.

“There were no major hiccups in terms of disruption to service that we were made aware of and Kirton’s lead times have actually dropped since moving to the new facilities.”

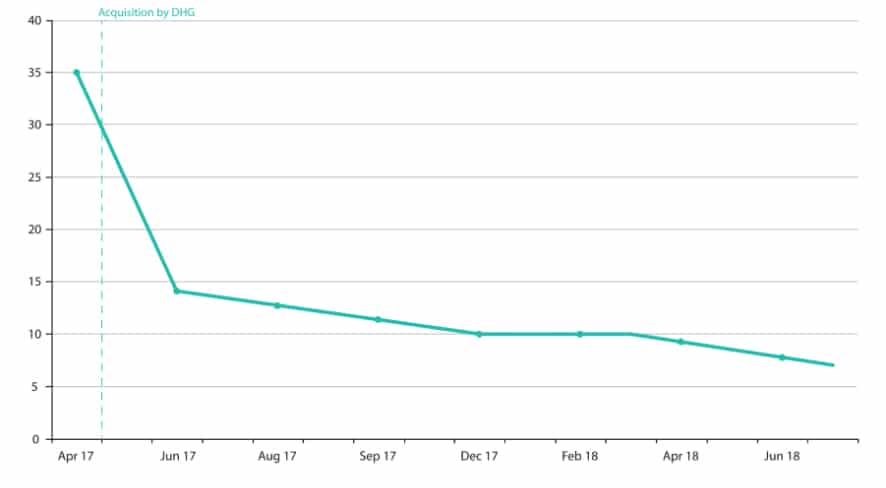

According to Rhys, the company was working to lead times of between 14 to 21 days on average before the acquisition, however, after becoming part of DHG, leads times have reduced to an average of 10 days.

“A lot of this is down to the original Kirton team sticking with the company and working well with colleagues in the DHS side of the business,” he said.

“We offered 98 percent of the Kirton staff their jobs in Caerphilly. Naturally, there were members of staff that chose to part ways which is fine and completely understandable, however, fortunately, a lot of the team with decades of experience decided to stay and move with the company.”

The retention of knowledgeable and committed members of staff has been one of the key factors in the acquisition’s success says Rhys, as well as bringing in the right people to fill the boots of those who left.

“What is important for us is to make sure we manage that process correctly by bringing in the right people who have that relevant industry experience to help drive the company going forward,” he underlined.

“We have employed some new faces to the team, however, a lot of these will not be new faces to the industry, as they have a lot of experience with the specialist seating sector or a related field like pressure care.”

Integration for innovation

“The next goal for the company is to try and get those lead times even lower, which is achieved through constant, incremental improvements to our processes,” confirmed Rhys.

“Each acquisition helps us further our objective of delivering new innovations to the market and I think the specialist seating market, in particular, is one that needs some innovation injected into it.

“There are a lot of me-too products out there so our drive is to have a real differentiator in the market. This means for Kirton, there is going to be a real investment in research and development going forward.”

Having retained the majority of Kirton’s R&D capabilities, DHG says it is now well placed to deliver industry-leading products to the market.

“Retaining that R&D expertise is a big bonus and so vital to being competitive in this industry,” emphasised Rhys.

“This, coupled with the R&D expertise we already had at DHS, means that we have the knowledge and investment in-house to really push the industry forward in terms of innovation.”

According to Rhys, this collaboration of R&D capability is already paying dividends, with DHG planning to unveil and showcase a new product at 2018’s OT Show in November.

A clinical approach

As well as differentiating its product offering, the company is keen to invest in research to help back-up the benefits of its products amongst healthcare professionals.

“A key differentiator for us is going to be clinical evidence,” mentioned Rhys.

“The specialist seating market seems to rely a lot on anecdotal evidence, so we are going to be gathering a lot of substantial, clinical evidence over the next few months.”

Pointing out that this initiative is still in its early stages, Rhys says it is an area that the company is willing to invest time and money in developing over the next 12-months.

“The specialist seating market seems to rely a lot on anecdotal evidence, so we are going to be gathering a lot of substantial, clinical evidence” Rhys Donovan

“We will be working with a number of different professionals and researchers in the coming months and we are also in talks with a university,” he finished.

“In addition, we will also be working with the Welsh Wound Innovation Centre, who we already have a close relationship with.

“The process takes time but it is certainly something that needs to be done to help us really engage with healthcare professionals and provide valuable information that will again, play an important role in our drive for innovation.”

https://thiis.co.uk/more-about-kirton-healthcare/https://thiis.co.uk/wp-content/uploads/2018/11/Kirton-Healthcare-1.jpeghttps://thiis.co.uk/wp-content/uploads/2018/11/Kirton-Healthcare-1-150x150.jpegSupplier SpotlightTrade Focusacquisition,DHG,Direct Healthcare Group,healthcare sector,Kirton Healthcare,Mobility Industry,More about,rhys donovan,Specialist seatingConsolidation driving differentiation In recent years, the number of mergers and acquisitions in the healthcare industry and particularly in the world of mobility, independent living and pressure care have been on the rise. Acquisitions however can be a tricky business and a process that, if managed poorly, can lead to...Calvin BarnettCalvin Barnettcalvin.barnett@bhta.comAuthorTHIIS Magazine