EXCLUSIVE: A snapshot of the state of play in the mobility retail sector after lockdown

In June, shoppers were once again able to venture out to shops as mobility retailers had a chance to catch their first glimpses of the state of retail after lockdown.

After three months of retail hiatus, as well as new COVID-19 Secure guidelines and the looming hazard of coronavirus still hanging in the air, THIIS conducted a survey to discover if consumers embraced the new normal of retail or decided to stay away.

40 mobility retail bosses from across Britain answered the short survey the week following England’s and Northern Ireland’s official reopening of non-essential shops – days prior to the reopening of shops in Wales and Scotland – to provide a post-lookdown snapshot of the mobility retail sector.

The results revealed a mixed bag with green shoots for some who enjoyed higher than expected footfall. In spite of this, the findings highlighted a degree of trepidation in the market, with over three-quarters of respondents continuing to use the government’s furlough scheme and over one-third of retailers seeing footfall down between 60 to 100 per cent.

See the full analysis:

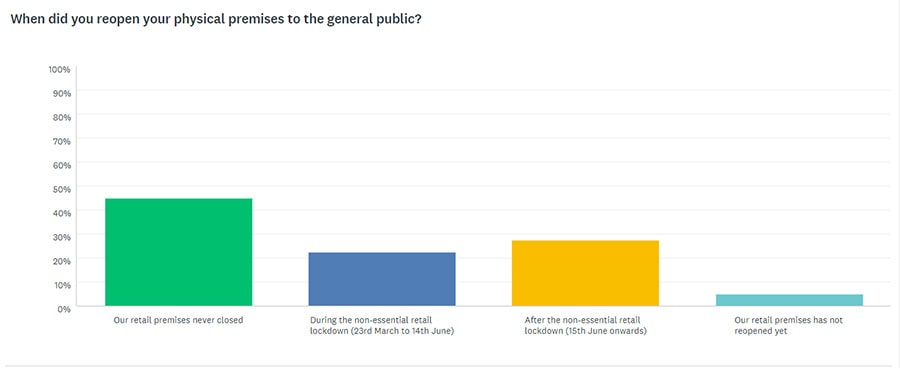

According to the data, 45 per cent of respondents kept their retail stores open throughout the pandemic whilst 22.5 per cent closed temporarily but reopened at some point during the lockdown.

27.5 per cent reopened on the 15th June and only 5 per cent remained closed until the 1st of July.

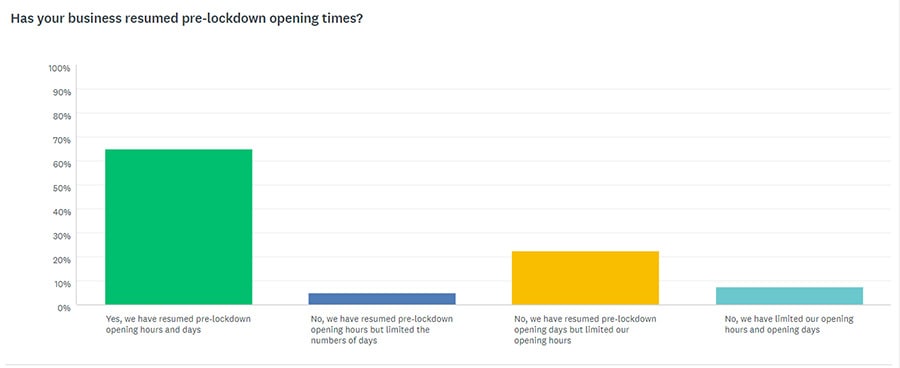

Encouragingly, 65 per cent of mobility retailers stated that they returned to their pre-lockdown opening hours and days.

22.5 per cent returned to their pre-lockdown opening days but with restricted opening hours, whilst only 5 per cent returned to their usual opening times but for fewer days in a week.

7.5 per cent limited both opening days and times.

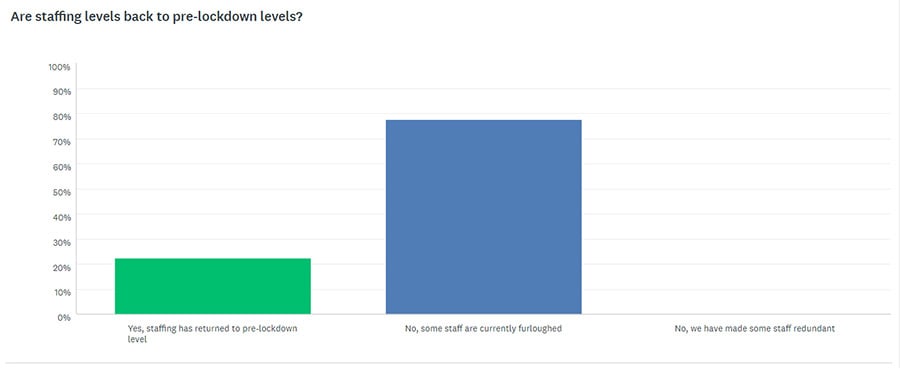

Despite the severe drop in demand and trade, alongside the temporary closure of stores, none of the 40 retailers who responded to the survey had made staff redundant – a promising statistic.

The majority of retailers – 77.5 per cent – were still using the government’s furlough scheme whilst they got a lay of the land whilst 22.5 per cent reported staffing levels were back to where they were before lockdown.

It remains to if redundancies will rise as the government’s furlough scheme is rolled back in the coming weeks and companies are required to pay in a percentage of furloughed workers’ wages.

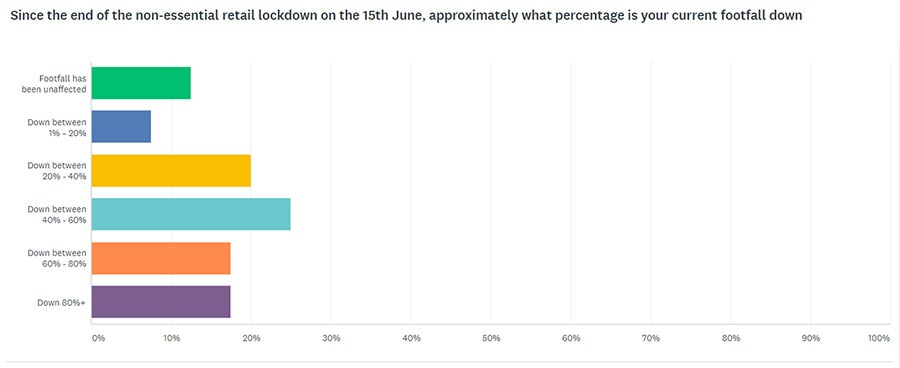

The level of footfall post-lockdown compared to pre-lockdown was highly varied, with 12.5 per cent experiencing no change in footfall levels. 7.5 per cent also saw a marginal fall of between 1 to 20 per cent.

20 per cent saw footfall decline slightly more significantly by 20 to 40 per cent and the majority of respondents – 25 per cent – observed a drop of 40 to 60 per cent.

On the other end of the spectrum, 17.5 per cent noted a 40 to 60 per cent falloff of footfall and the same percentage also saw the sharpest decline of 80+ per cent.

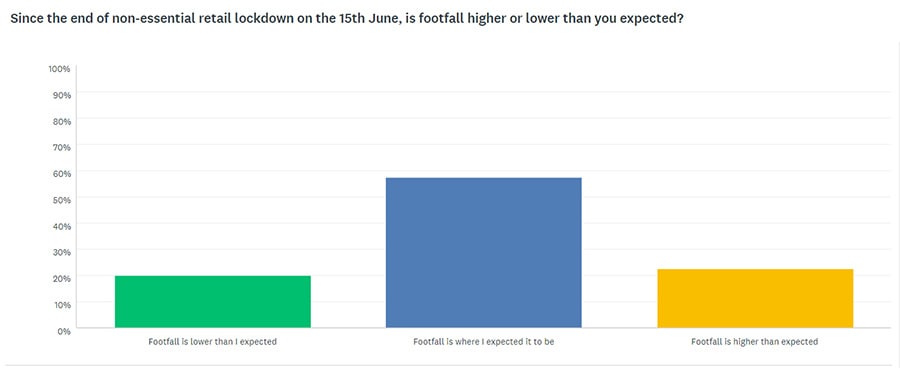

In spite of the mixed results relating to the level of footfall decline, the majority of respondents – 57.5 per cent – confirmed that the level of footfall was where they expected it to be.

20 per cent reported footfall was lower than expected, however, promisingly, 22.5 per cent stated footfall was higher than they thought it would be after lockdown.

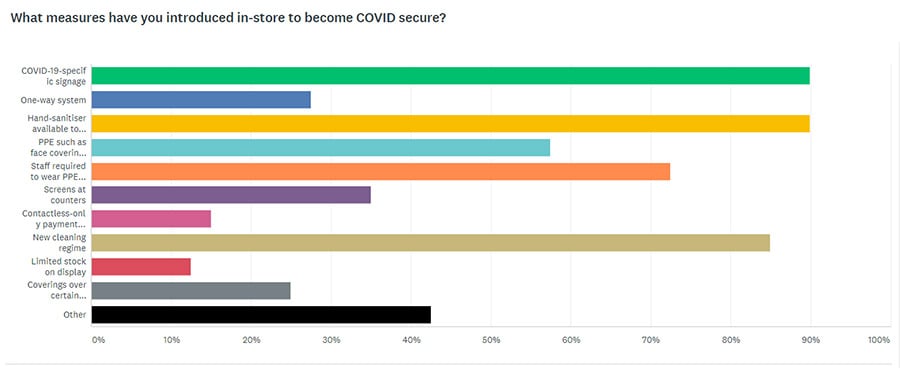

With respondents able to choose multiple answers, the overwhelming majority of mobility retailers – 90 per cent – reported introducing new COVID-19 signage and making hand sanitiser available for customers as the two key COVID-19 Secure measures.

These were closely followed by retailers implementing new cleaning regimes, as selected by 85 per cent of respondents, as well as 72.5 per cent of companies requiring staff to wear PPE.

Around half of the respondents – 57.5 per cent – also made PPE including gloves and face coverings available to customers in their stores.

Less common measures introduced included screens at counters – 35 per cent – and one-way traffic systems in stores – 27.5 per cent.

In addition, only one in four respondents reported using coverings over specific product ranges.

Least adopted measures were the introduction of contactless-only payments – 15 per cent – and limiting the number of products on display in store – 12.5 per cent.

Among the 42.5 per cent of ‘Other’ measures brought in by mobility retailers to reduce the chance of COVID-19 transmission were:

- Appointment-only’ policies

- Doorbell entrance system

- Customer and staff temperature checks

- Outdoor viewings – weather permitting

- ‘Clean me’ stickers placed on customer-handled products

- Chemical spray of all products

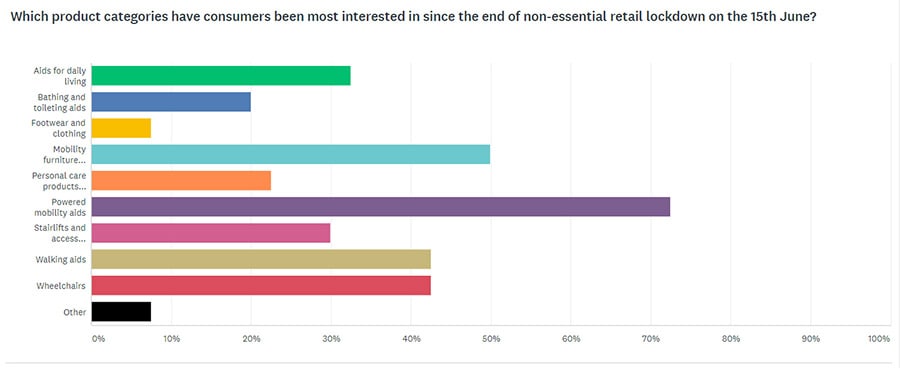

With mobility retailers able to pick multiple categories, the overwhelming majority of mobility retailers – 72.5 per cent – reported ‘powered mobility aids’ enjoyed the highest post-lockdown demand.

This was followed by mobility furniture, such as riser recliner chairs, at 50 per cent and walking aids and wheelchairs at 42.5 per cent each.

32.5 per cent witnessed post-lockdown demand for aids for daily living and 30 per cent for stairlifts, whilst personal care products (22.5 per cent), bathing and toileting aids (20 per cent) and footwear & clothing (7.5 per cent) saw the lowest demand.

In addition, mobility retailers also noted that demand for repairs was high, as well as limited demand for car adaptations.

Suggesting that big-ticket products which often require a degree of assessment or consultation saw the largest amount of pent-up demand during the lockdown, the data may indicate that smaller, lower-cost products may have continued to have been purchased throughout lockdown.

To take part in THIIS’ surveys, be sure to sign up for the THIIS twice-weekly email to find out more about the next one. Share your thoughts and experiences anonymously to help provide valuable insights for the industry.

https://thiis.co.uk/exclusive-a-snapshot-of-the-state-of-play-in-the-mobility-retail-sector-after-lockdown/https://thiis.co.uk/wp-content/uploads/2020/07/reopening-of-retail.jpghttps://thiis.co.uk/wp-content/uploads/2020/07/reopening-of-retail-150x150.jpgCoronavirus NewsCOVID-19 Trade NewsNewsroomReports & ResearchRetailer NewsSector NewsSupplier NewsTrade Newscoronavirus,COVID-19,COVID-19 Secure,footfall,furlough,mobility retail sector,post-lockdown,research,retail reopening,surveyIn June, shoppers were once again able to venture out to shops as mobility retailers had a chance to catch their first glimpses of the state of retail after lockdown. After three months of retail hiatus, as well as new COVID-19 Secure guidelines and the looming hazard of coronavirus still...Calvin BarnettCalvin Barnettcalvin.barnett@bhta.comAuthorTHIIS Magazine