Coronavirus Job Retention Scheme extension explained: Everything mobility leaders need-to-know

On the 29th May, chancellor Rishi Sunak outlined the details of Coronavirus Job Retention Scheme extension, confirming employers will be able to bring back staff on a part-time basis from 1st July onwards, rather than the 1st August.

Since the outbreak of the coronavirus and subsequent lockdown in March, the government’s furlough scheme has proven to be a lifeline to employees and employers, helping to prevent mass unemployment.

According to Sunak, the initiative has helped one million employers across the UK furlough 8.4 million jobs, protecting people’s livelihoods and hopefully enabling companies to be able to bounce back as lockdown measures are relaxed over the coming months.

With large swathes of the UK economy still unable to return to work or working at a far lower capacity, the chancellor confirmed in mid-May that the Coronavirus Job Retention Scheme would be extended until the end of October.

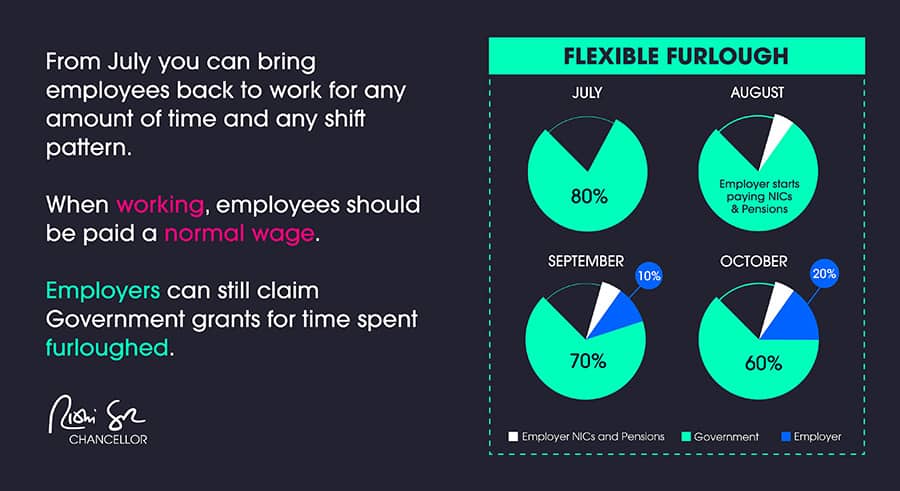

Sunak also highlighted that the scheme would change over the duration of the scheme leading to a gradual tapering off, with companies expected to contribute more as the scheme went on, as well as an option for companies to furlough employees on a part-time basis.

The phased changes schedule

June

Throughout June, the scheme will continue as it has since March. The government will continue to pay 80 per cent of furloughed people’s wages, up to a maximum of £2,500.

July

The government will continue to pay the same amount as previously, with no contributions being required by business.

From the 1st of July, Flexible Furlough will begin, allowing businesses to bring furloughed employees back on a part-time basis.

According to the government, companies will be able to decide the hours and shift patterns of returning employees and will be responsible for paying the wages of the hours that employees work.

For the hours that the employee is furloughed, the government will pay the 80 per cent rate.

August

From the 1st of August 2020, the government has committed to continue to pay the 80 per cent of furloughed employee’s salaries (up to £2,500), however, employers will have to meet the cost of

From 1 August 2020, the government will continue to pay 80% of the furloughed employees’ salary (subject to the £2,500 cap), but employers will have to meet the cost of employers national insurance contributions (ER NIC) and pension contributions.

According to the chancellor, this will represent 5 per cent of the gross employment costs that an employer would incur if the employee had not been furloughed.

September

September marks employers being required to contribute to the furlough claim of its employees. The government will pay 70 per cent of wages (capping at £2,187.50) whilst employers will be required to pay ER NIC and pension contributions, as well as 10 per cent of wages to make up the 80 per cent total.

The government says this employer contribution represents 14 per cent of the gross employment cost of the employee.

October

The final month of the scheme – unless another extension is rolled out – will see the government pay 60 per cent of wages, up to a cap of £1,875.

Employers will pay ER NICs and pension contributions and 20 per cent of wages to make up 80 per cent, with the average claim representing 23 per cent of the gross employment costs.

Scheme cut-off deadline

The scheme will close to new applicants at the end of June, meaning employers wishing to use the furlough scheme must place employees on furlough by the 10th of June – this allows time to complete the three required minimum weeks.

With many retailers not reopening their doors to customers until the official 15th of June date announced by the prime minister, mobility dealers will need to try and predict the level of demand expected and whether staff can be spared or not during that three-week period.

https://thiis.co.uk/coronavirus-job-retention-scheme-extension-explained-everything-mobility-leaders-need-to-know/https://thiis.co.uk/wp-content/uploads/2020/06/furlough-scheme.jpghttps://thiis.co.uk/wp-content/uploads/2020/06/furlough-scheme-150x150.jpgBusiness SupportCoronavirus NewsCOVID-19 Sector NewsCOVID-19 Trade NewsGovernment & Local AuthoritiesInvestments & FundingNewsroomRetailer NewsSector NewsSupplier NewsTrade Newsbusiness contributions,chancellor,Coronavirus Job Retention Scheme extension,COVID-19,ER NIC,furlough scheme,pension contributions,Prime Minister,Rishi SunakOn the 29th May, chancellor Rishi Sunak outlined the details of Coronavirus Job Retention Scheme extension, confirming employers will be able to bring back staff on a part-time basis from 1st July onwards, rather than the 1st August. Since the outbreak of the coronavirus and subsequent lockdown in March, the...Calvin BarnettCalvin Barnettcalvin.barnett@bhta.comAuthorTHIIS Magazine