Budget 2020: The need-to-know for mobility retailers, manufacturers and importers

As the government moves to protect businesses in the wake of the coronavirus, THIIS has summarised the key spending and tax plans set to impact mobility businesses in the new government’s first Budget.

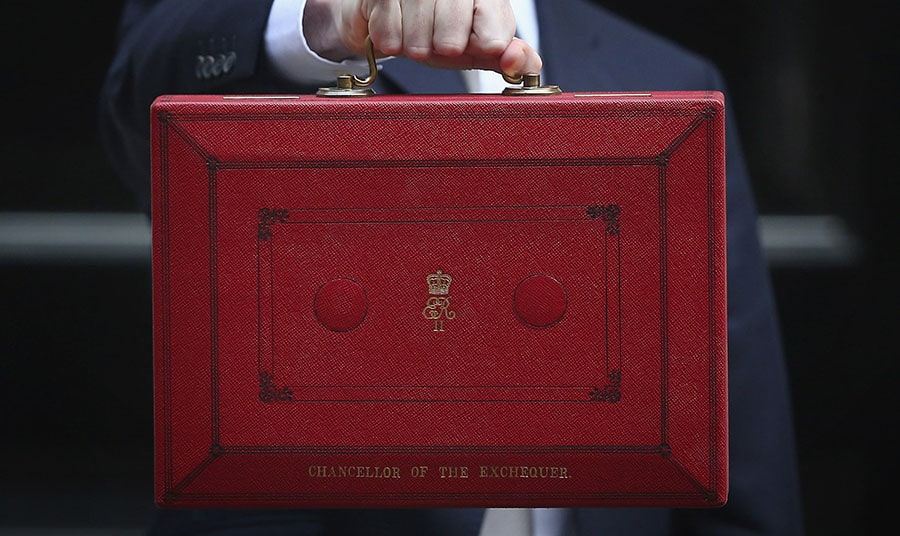

Described as a seismic shift in fiscal policy, the Budget delivered by chancellor Rishi Sunak on the 10th March 2020 included a £30bn package to help the economy and businesses through the coronavirus outbreak.

Addressing the Commons, he highlighted that disruption caused by coronavirus expected across all sectors will be significant but temporary and promised to take all action necessary to protect the economy and businesses.

“The right immediate policy response is to provide security and support for those who get sick or can’t work through funding our public services, and a strengthened safety net,” said chancellor Rishi Sunak. “And on the supply side, the right response is to provide a bridge for businesses, to ensure that what is a temporary impact on our productive capacity does not become permanent.”

Key points for mobility retailers and suppliers:

Statutory sick pay for all: All mobility retail and supplier staff advised to self-isolate as a result of coronavirus will be entitled to statutory sick pay from day one, even if they have not presented with symptoms

Government to pick up the cost: Mobility retailers and suppliers with less than 250 employees will be refunded for sick pay payments for up to 14 days

Coronavirus support: To help with mobility companies’ liquidity and cashflow during the disruption, a ‘Coronavirus Business Interruption Loan Scheme’ will see the government guarantee bank loans to small businesses on amounts of up to £1.2m

Potholes fund: Good news for mobility companies’ fleets of vehicles and powered mobility users as the government confirmed £500m to be spent per year from 2020-21 to 2024-25 to address the scourge of potholes – earlier in the year, a mobility scooter user was severely injured after an accident caused by a pothole

Changing Places changes: Representing an opportunity for Changing Places equipment installers and suppliers, the government will change building regulations guidance to mandate the provision of Changing Places toilets in new public buildings by the end of this year

Changing Places fund: The Budget also confirmed the launch a £30m Changing Places Fund, working with the Changing Places Consortium and others to identify those sectors where we most need to accelerate the provision of such facilities in existing buildings – discover more about the new match-fund

Key points specifically for mobility retailers:

Business rates holiday: Retailers with a rateable value of less than £51,000 will be eligible for a business rates tax holiday, abolishing the tax by 100 per cent for the next financial year – discover mobility retailers’ response

Business rate review: A comprehensive review of the high street business rates to be carried out and a report to be published in the autumn

Small business grant funding: For small businesses that pay little or no business rates because of Small Business Rate Relief, the government will provide a £3,000 cash grant to help meet ongoing business costs and rent

Key points specifically for mobility manufacturers and importers:

Plastic waste tax: From April 2022, manufacturers and importers will incur a charge of £200 per tonne on packaging made of less than 30 per cent recycled plastic

VAT postponed accounting: From 1 January 2021, postponed accounting for VAT will apply to all imports of goods, including from the EU to aid VAT registered UK businesses which are integrated in international supply chains as they adapt to life after Brexit

Regional exports and investment: The Department of International Trade will drive investment into and end-to-end support for exporters from the Northern Powerhouse, the Midlands Engine and the Western Gateway through dedicated local champions based at key overseas posts

R&D tax cut: The Research and Development Expenditure credit will be increased from 12 per cent to 13 per cent – a tax cut worth £2,400 on a typical R&D claim